August 02, 2019

There are a number of alternatives open to an investor who wishes to do business in Poland. These alternatives include:

-

- being a sole trader (or the so called ‘economic activity’)

- establishing a branch office

- establishing a Polish subsidiary company

- acquiring an existing Polish company

-

There is no “one size fits all” answer, and deciding whether you should run your Polish business as a sole trader, a branch or a limited liability company can change depending on the circumstances.

As well as tax, legal and regulatory consideration, there are a number of commercial factors to consider when deciding which of these alternatives is the most appropriate, such as, product origin, available funding, size of the business, clientele and the level of risk to be incurred.

The majority of foreign entities wishing to do business in Poland set up a branch or incorporate a subsidiary. Sole trader option is popular for smaller operations. Further details on each of these are set out below in a table.

Sole trader

Being a sole trader means being in business on your own. It’s a relatively straightforward structure, where you are self-employed and, legally, you and your business are considered as one. It’s the most common structure used by self-employed individuals and small businesses. This option is available without any restrictions to the EU citizens.

Branch office

The main point to note about operating a branch is that it is not a separate legal entity. This means that the foreign company is directly responsible for the operations and liabilities of the Polish establishment. The main company needs to designate an authorised person who will represent the branch in Poland. The branch can also directly hire employees for the Polish establishment.

The Polish establishment is required to run the accounting books and is obliged to file the annual accounts with the commercial court. The branch may also be subject to Polish income tax (if the activity of the branch brings profit).

Limited liability company

The main benefit of a company limited by shares is that the liability of the shareholders is limited to the amount paid on their shares in the company. It follows that if the shares are fully paid up, the shareholders will not normally be liable to contribute further amounts in the event of the company becoming insolvent. A company is a separate legal entity, distinct from its shareholders and directors. This makes it an attractive proposition for a foreign investor looking to establish a business in Poland. Separate legal entity status enables the company to enter into contracts directly and offers the parent company protection from the subsidiary’s liabilities.

Establishing a limited liability company is a straightforward process which can usually be completed within 2 weeks.

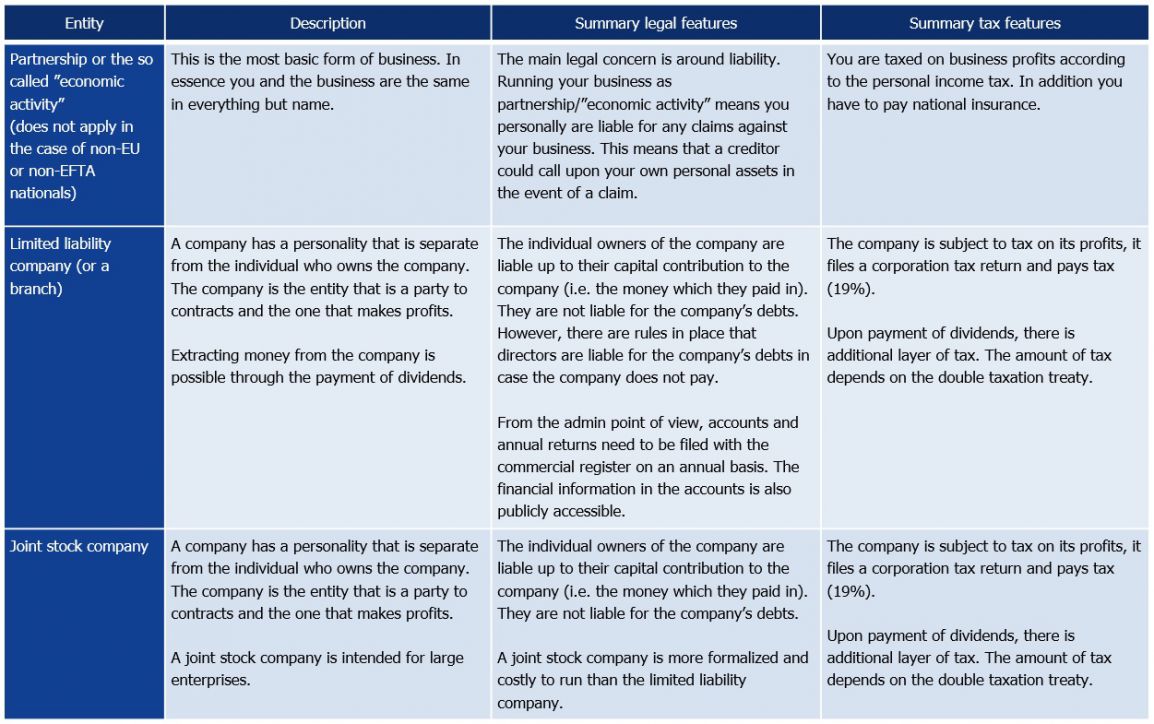

Below, we present some basic information about the most common business structures which are available in Poland:

What is the right business structure for you and whether a limited liability company will be the most appropriate choice – this should be established by your advisors. Getting things right from the start will increase your chances for a successful investment.

Read also

April 22, 2024

How to choose the right business structure in Poland...

The business structure you choose influences everything from day-to-day operations, to taxes and how much of your personal assets are at risk....

Read moreMarch 28, 2024

Wozniak Legal recognized in The Legal 500 EMEA 2024...

Wozniak Legal is pleased to share that The Legal 500 Europe, Middle East and Africa (EMEA) 2024 edition has recognized our firm for legal...

Read moreMarch 27, 2024

Fundacja rodzinna jako zabezpieczenie sukcesji

W maju 2023 r. weszła w życie ustawa o fundacji rodzinnej, wprowadzająca nowe w polskim prawodawstwie rozwiązanie w postaci fundacji rodzinnej....

Read more