January 17, 2018

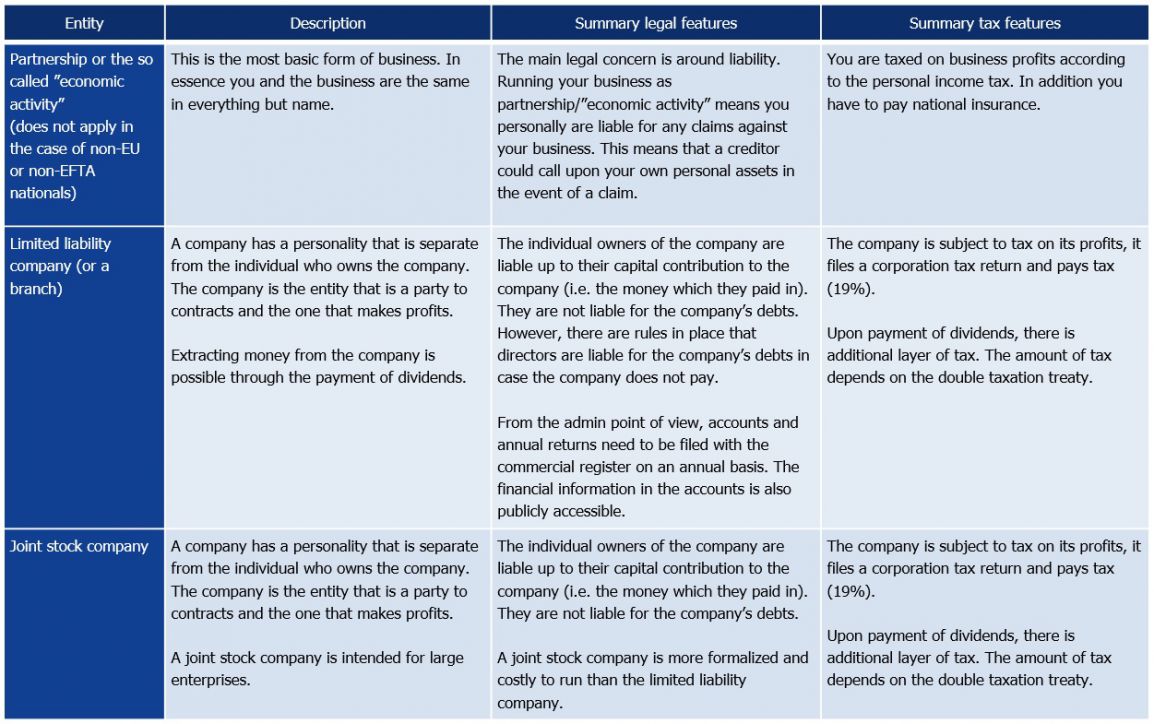

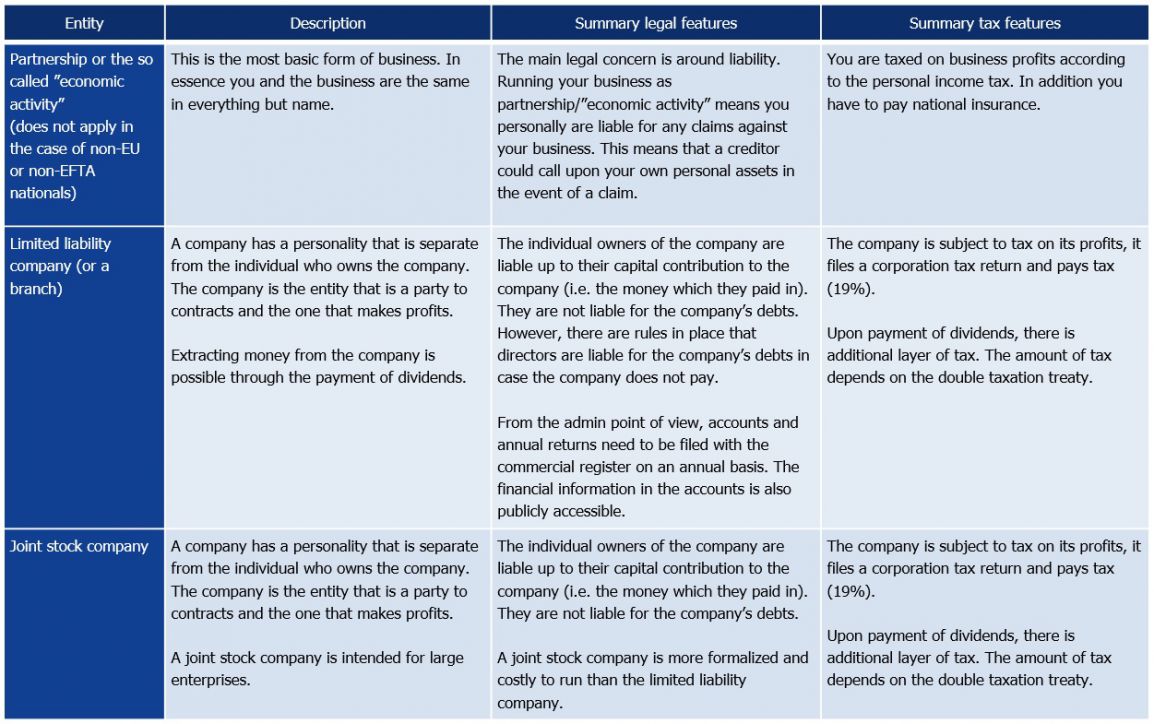

Sole trader, partnership, limited liability company or may be the joint stock company? There is no “one size fits all” answer, and deciding whether you should run your Polish business as a sole trader or a limited liability company can change on various circumstances.

The recent forecast of GDP growth for 2018 in Poland is promising. According to the recent prognosis of the World Bank, Polish economy will grow 4 % which is the highest rate in Europe.

Why the prospects for Poland are so good? The first positive feature is Poland’s rising importance as a regional leader. Poland is a key player in the Intermarium project (a group of 12 states in the Central and Eastern Europe) which assumes closer integration of the CEE countries and deliveries of the LNG from the US. Delivering natural gas to Poland and establishing a solid network of CEE countries on the north-south axis could be a game-changer. In this way, Poland has a great chance of becoming a regional powerbroker, with the prospect of playing an important role on the international arena.

A second positive feature is strong internal market in Poland and attractiveness of its real estate market. It is a golden age for the Polish real estate projects.

If your business is going to operate not only in Poland but in other European countries too, you need to plan in advance how can you fit your business in the complex world of international tax and legal agreements. You need expert advice in all the countries you are going to operate.

Being a sole trader means being in business on your own. It’s a relatively straightforward structure, where you are self-employed and, legally, you and your business are considered as one. It’s the most common structure used by self-employed individuals and small businesses.

On the other hand - a limited liability company is legally separate from the individuals who set it up, so it is responsible for its own debts. If things go wrong, it’s the company that goes bust, not you – as long as you can establish that you have run the operation legally and in good faith.

Limited liability companies can also add to your credibility if you’re dealing with other businesses. On the downside, you are required to submit annual accounts to Commercial Court, and there is an increased level of administration and government regulation to deal with.

Below, I present some basic information about the most common business structures which are available in Poland, and some of the questions you need to ask before making your mind up, or seeking out the professional help.

The most common choice for investors in Poland is a limited liability company which is similar to a German GmbH or Italian societa a responsabilita limitata. What is the right business structure for you and whether a limited liability company will be the most appropriate choice – this should be established by your advisors. Getting things right from the start will increase your chances for a successful investment.

The recent forecast of GDP growth for 2018 in Poland is promising. According to the recent prognosis of the World Bank, Polish economy will grow 4 % which is the highest rate in Europe.

Why the prospects for Poland are so good? The first positive feature is Poland’s rising importance as a regional leader. Poland is a key player in the Intermarium project (a group of 12 states in the Central and Eastern Europe) which assumes closer integration of the CEE countries and deliveries of the LNG from the US. Delivering natural gas to Poland and establishing a solid network of CEE countries on the north-south axis could be a game-changer. In this way, Poland has a great chance of becoming a regional powerbroker, with the prospect of playing an important role on the international arena.

A second positive feature is strong internal market in Poland and attractiveness of its real estate market. It is a golden age for the Polish real estate projects.

If your business is going to operate not only in Poland but in other European countries too, you need to plan in advance how can you fit your business in the complex world of international tax and legal agreements. You need expert advice in all the countries you are going to operate.

Being a sole trader means being in business on your own. It’s a relatively straightforward structure, where you are self-employed and, legally, you and your business are considered as one. It’s the most common structure used by self-employed individuals and small businesses.

On the other hand - a limited liability company is legally separate from the individuals who set it up, so it is responsible for its own debts. If things go wrong, it’s the company that goes bust, not you – as long as you can establish that you have run the operation legally and in good faith.

Limited liability companies can also add to your credibility if you’re dealing with other businesses. On the downside, you are required to submit annual accounts to Commercial Court, and there is an increased level of administration and government regulation to deal with.

Below, I present some basic information about the most common business structures which are available in Poland, and some of the questions you need to ask before making your mind up, or seeking out the professional help.

The most common choice for investors in Poland is a limited liability company which is similar to a German GmbH or Italian societa a responsabilita limitata. What is the right business structure for you and whether a limited liability company will be the most appropriate choice – this should be established by your advisors. Getting things right from the start will increase your chances for a successful investment.

Read also

January 29, 2026

NDAs: Essential Shields for Trade Secrets in Poland's...

In today's competitive landscape, proactive secret management isn't optional - it's a strategic edge. Non-disclosure agreements (NDAs) have become...

Read moreJanuary 16, 2026

Practical Steps to Transfer Shares in a Polish Sp z...

Are you going to transfer shares in a Polish sp z o.o.? Follow the Commercial Companies Code strictly or risk invalidity. Transferring...

Read moreJanuary 15, 2026

WEBINAR: Practical Steps to Transfer Shares in Polish...

Transferring shares in a Polish sp. z o.o. requires a structured process governed by the Commercial Companies Code to ensure legal validity,...

Read more