September 10, 2024

Whether you are an established multinational company, a small business owner or launching a startup, there are numerous benefits to owning a business in Poland as a foreigner.

First, the Polish economy is booming. The fast economic growth made Poland one of the most productive and dynamically growing economies in Europe. Poland has experienced uninterrupted growth over three decades, the longest in European history. Its GDP has increased tenfold nominally, sixfold when corrected for the cost of living. It has a record low unemployment rate in Europe and good economic indicators.

Second, low cost of production as well as fast developing infrastructure, beneficial taxation and subsidies for investment are important advantages if you are looking for a place to invest.

Third, a strategic location: situated in Central Europe, Poland has a strategic location between the western and the eastern sides of the continent.

Fourth, access to the Baltic sea which offers additional transport and trade benefits. There are big projects on the horizon. Poland is planning to spend USD 40 billion to build two nuclear power plants with three reactors each. A Polish government agency has signed an agreement with a local maritime authority for the expansion of the water transport infrastructure in the outer port of Swinoujscie in northwestern Poland. This will transform Swinoujscie into one of the largest ports in the Baltic Sea area.

Fifth, membership in the EU and the Schengen area is crucial for investors as by entering Poland, the investors also receive the key to a wider EU market.

Sixth, highly qualified and hardworking people, especially in the tech sector. One of the reasons Poland is famous for top-class IT specialists is that the country used to be a superpower in the field of mathematics before the World War 2.

Seventh, Poland is safe and stable. Despite the war in Ukraine, Poland remains a stable investment location, being a member of the most strategic alliances, such as NATO, and economic – such as the EU. Its attractiveness in investors’ eyes is also influenced by the reliable banking sector and mature financial sector, well-developed infrastructure and the increasing value of foreign direct investments.

What is the right business structure in Poland? There is no one-size-fits-all solution and all depends on your plans. Your business structure will determine which set of rules and taxes will apply to your business. Broadly, there are three most common types of business structures available for foreign investors in Poland:

Sole proprietorship: A sole proprietorship (or a sole trader) means being in business on your own. It’s a relatively straightforward structure, where you are self-employed and, legally speaking, you and your business are considered as one. It’s the most common structure used by self-employed individuals and small businesses in Poland. This option is available without any restrictions to the EU citizens but it is not avaiable to non-EU nationals or non-EFTA nationals.

With a sole proprietorship, you are the sole owner of the business, which means there is no separation from the business entity and you as a person.

The advantage of this structure is that you can make all of the decisions alone; it gives you maximum control over your business. Moreover, this simple business structure is fast and easy to set up and does not incur a lot of costs. To set up your sole proprietorship, you only need to register your trade name in the commercial register run by the municipality.

The downside of being a sole trader is that you can be held liable for debts and contracts of the business.

Limited liability company (LLC): LLCs create a separate legal business entity that protects the business owner from personal liability, thus protecting your personal assets. This makes it an attractive proposition for a foreign investor looking to establish a business in Poland. Separate legal entity status enables the company to enter into contracts directly and offers you or your parent company protection from the subsidiary’s liabilities. It must be remembered that members of the management board of the LLC are personally liable for the debts of the Polish company in the situation where the enforcement against the company turns out to be ineffective. The shareholders are not liable for the company’s obligations and their financial risk is limited only to the amount invested in the company’s share capital.

In principle, there are two obligatory statutory governing bodies of a company: a management board and Shareholders’ Meeting. A supervisory board is obligatory only when certain conditions are met in terms of the share capital amount and the number of shareholders engaged into the shareholding structure of the company.

Incorporation of a limited liability company requires Articles of Association to be executed before a Polish notary public. Execution of the notarial deed covering this document can be done on the basis of powers of attorney, however, in such a case these powers of attorney shall be drawn-up in the notarial form, and, if executed abroad, affixed with an apostille clause.

Joint stock company: A joint stock company has a personality that is separate from its shareholders and members of the management board (exactly as in the case of a limited liability company). Separate legal entity status enables the company to enter into contracts directly and offers the parent company protection from the subsidiary’s liabilities. A joint stock company is intended for large businesses. It should be remembered that the joint stock company requires also substantial paperwork and administrative work therefore it is intended usually for large and well-established businesses that need substantial liability protection.

Incorporation of a joint stock company also requires Articles of Association to be executed before a Polish notary public. Execution of the notarial deed covering this document can be done on the basis of powers of attorney, however, in such a case these powers of attorney shall be drawn-up in the notarial form, and, if executed abroad, affixed with an apostille clause.

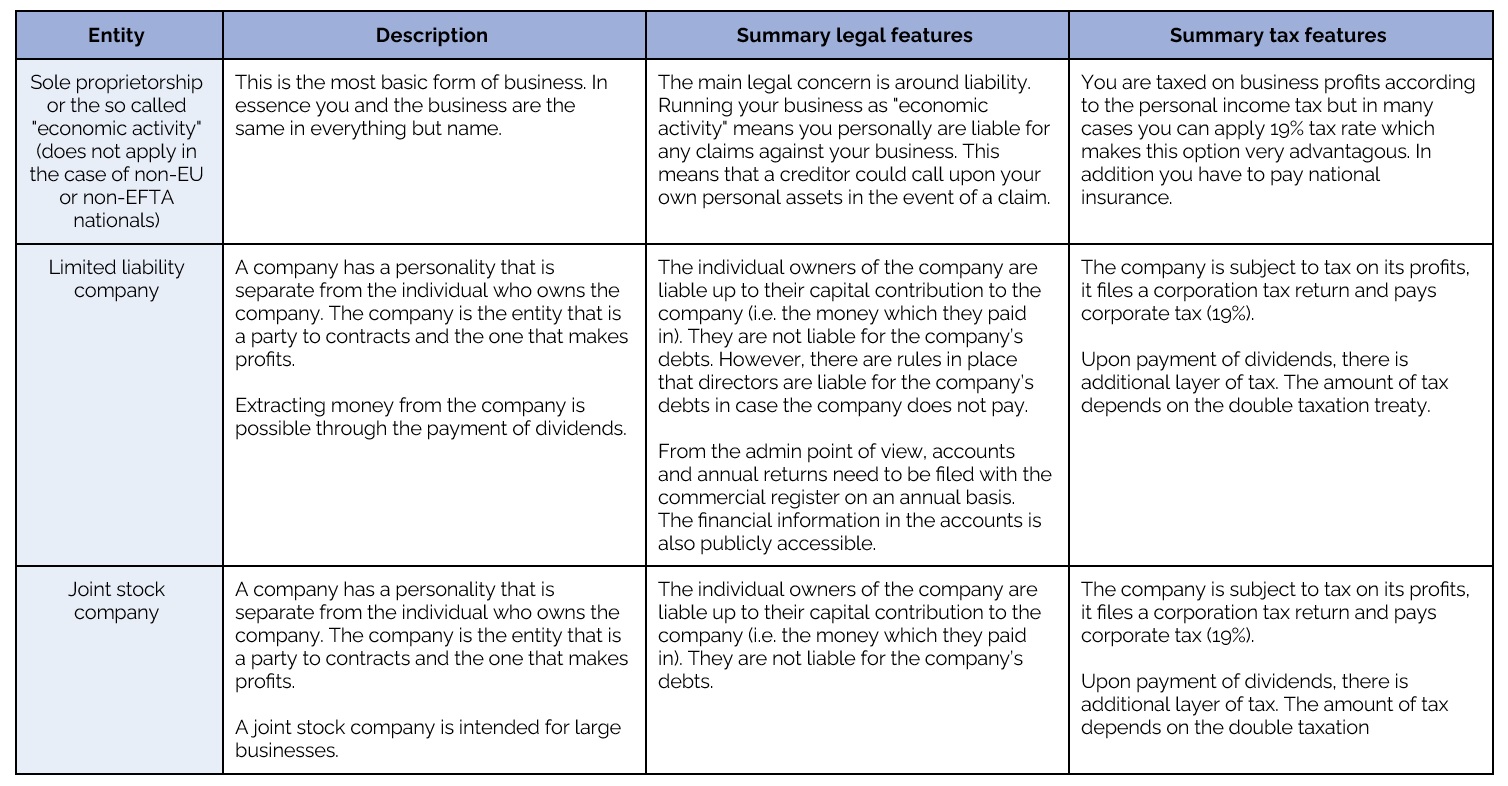

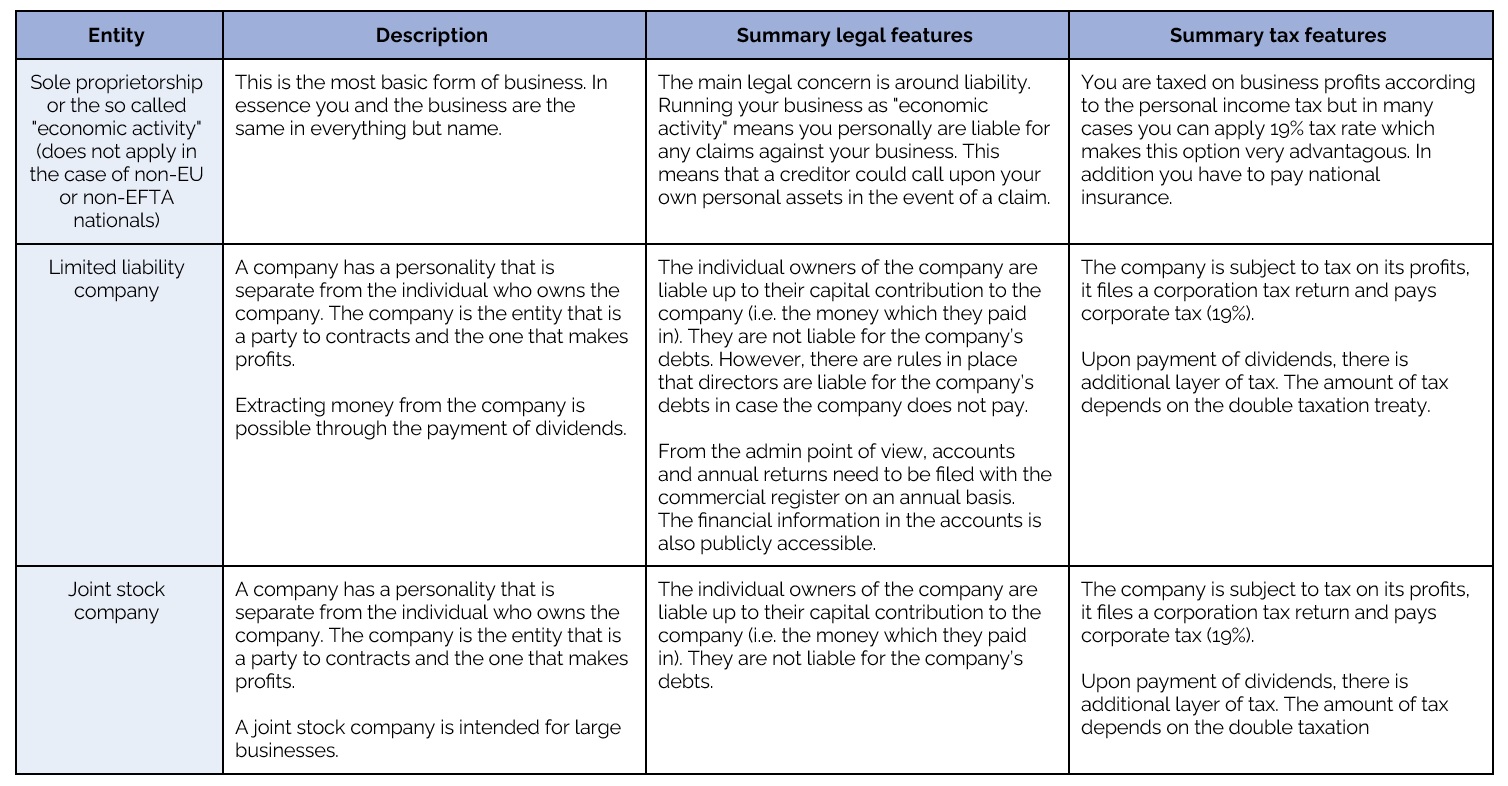

The table below summerizes the main features of the most common types of business structures in Poland:

When you are evaluating which structure to choose, it is important to think through these three factors:

Potential size and liability protection: with each business structure, even a sole proprietorship, you will have employees. If you intend to be a larger, more complex business, an LLC may make more sense than a sole proprietorship. Also, if you have personal assets that you would like to protect or are wary of assuming full liability for business-related debts and obligations, then an LLC may be better suited for your business. When you run a business, you’re at greater risk for a lawsuit because businesses interact with the world and usually a lot of money is involved.

In a sole proprietorship, if your business is sued and loses, your personal assets — real estate, cars, bank accounts — can be targets for the parties seeking to collect damages. The same can be said, in some cases, if you default on a business loan and you signed a personal guarantee. The lender can attempt to recover its investment from your personal property.

LLCs and joint stock companies limit their shareholders’ liability, so personal assets are protected.

Taxes: How you and your business are taxed is dependent on the business structure you choose. You should evaluate the different types of taxes that come with each structure. Polish tax law is complicated and full of exemptions – it is always beneficial to consult a tax lawyer.

If your business is going to trade in more than one country, you need to plan how to fit your business structure into the complex world of international tax.

Funding: typically, lenders are wary of providing funding to sole proprietorships. These types of business structures are sometimes seen as riskier investments. If you are focused on receiving funding from an outside lender, be sure to understand the type of business structure they prefer. LLCs and joint stock companies offer more opportunities.

First, the Polish economy is booming. The fast economic growth made Poland one of the most productive and dynamically growing economies in Europe. Poland has experienced uninterrupted growth over three decades, the longest in European history. Its GDP has increased tenfold nominally, sixfold when corrected for the cost of living. It has a record low unemployment rate in Europe and good economic indicators.

Second, low cost of production as well as fast developing infrastructure, beneficial taxation and subsidies for investment are important advantages if you are looking for a place to invest.

Third, a strategic location: situated in Central Europe, Poland has a strategic location between the western and the eastern sides of the continent.

Fourth, access to the Baltic sea which offers additional transport and trade benefits. There are big projects on the horizon. Poland is planning to spend USD 40 billion to build two nuclear power plants with three reactors each. A Polish government agency has signed an agreement with a local maritime authority for the expansion of the water transport infrastructure in the outer port of Swinoujscie in northwestern Poland. This will transform Swinoujscie into one of the largest ports in the Baltic Sea area.

Fifth, membership in the EU and the Schengen area is crucial for investors as by entering Poland, the investors also receive the key to a wider EU market.

Sixth, highly qualified and hardworking people, especially in the tech sector. One of the reasons Poland is famous for top-class IT specialists is that the country used to be a superpower in the field of mathematics before the World War 2.

Seventh, Poland is safe and stable. Despite the war in Ukraine, Poland remains a stable investment location, being a member of the most strategic alliances, such as NATO, and economic – such as the EU. Its attractiveness in investors’ eyes is also influenced by the reliable banking sector and mature financial sector, well-developed infrastructure and the increasing value of foreign direct investments.

What is the right business structure in Poland? There is no one-size-fits-all solution and all depends on your plans. Your business structure will determine which set of rules and taxes will apply to your business. Broadly, there are three most common types of business structures available for foreign investors in Poland:

Sole proprietorship: A sole proprietorship (or a sole trader) means being in business on your own. It’s a relatively straightforward structure, where you are self-employed and, legally speaking, you and your business are considered as one. It’s the most common structure used by self-employed individuals and small businesses in Poland. This option is available without any restrictions to the EU citizens but it is not avaiable to non-EU nationals or non-EFTA nationals.

With a sole proprietorship, you are the sole owner of the business, which means there is no separation from the business entity and you as a person.

The advantage of this structure is that you can make all of the decisions alone; it gives you maximum control over your business. Moreover, this simple business structure is fast and easy to set up and does not incur a lot of costs. To set up your sole proprietorship, you only need to register your trade name in the commercial register run by the municipality.

The downside of being a sole trader is that you can be held liable for debts and contracts of the business.

Limited liability company (LLC): LLCs create a separate legal business entity that protects the business owner from personal liability, thus protecting your personal assets. This makes it an attractive proposition for a foreign investor looking to establish a business in Poland. Separate legal entity status enables the company to enter into contracts directly and offers you or your parent company protection from the subsidiary’s liabilities. It must be remembered that members of the management board of the LLC are personally liable for the debts of the Polish company in the situation where the enforcement against the company turns out to be ineffective. The shareholders are not liable for the company’s obligations and their financial risk is limited only to the amount invested in the company’s share capital.

In principle, there are two obligatory statutory governing bodies of a company: a management board and Shareholders’ Meeting. A supervisory board is obligatory only when certain conditions are met in terms of the share capital amount and the number of shareholders engaged into the shareholding structure of the company.

Incorporation of a limited liability company requires Articles of Association to be executed before a Polish notary public. Execution of the notarial deed covering this document can be done on the basis of powers of attorney, however, in such a case these powers of attorney shall be drawn-up in the notarial form, and, if executed abroad, affixed with an apostille clause.

Joint stock company: A joint stock company has a personality that is separate from its shareholders and members of the management board (exactly as in the case of a limited liability company). Separate legal entity status enables the company to enter into contracts directly and offers the parent company protection from the subsidiary’s liabilities. A joint stock company is intended for large businesses. It should be remembered that the joint stock company requires also substantial paperwork and administrative work therefore it is intended usually for large and well-established businesses that need substantial liability protection.

Incorporation of a joint stock company also requires Articles of Association to be executed before a Polish notary public. Execution of the notarial deed covering this document can be done on the basis of powers of attorney, however, in such a case these powers of attorney shall be drawn-up in the notarial form, and, if executed abroad, affixed with an apostille clause.

The table below summerizes the main features of the most common types of business structures in Poland:

When you are evaluating which structure to choose, it is important to think through these three factors:

Potential size and liability protection: with each business structure, even a sole proprietorship, you will have employees. If you intend to be a larger, more complex business, an LLC may make more sense than a sole proprietorship. Also, if you have personal assets that you would like to protect or are wary of assuming full liability for business-related debts and obligations, then an LLC may be better suited for your business. When you run a business, you’re at greater risk for a lawsuit because businesses interact with the world and usually a lot of money is involved.

In a sole proprietorship, if your business is sued and loses, your personal assets — real estate, cars, bank accounts — can be targets for the parties seeking to collect damages. The same can be said, in some cases, if you default on a business loan and you signed a personal guarantee. The lender can attempt to recover its investment from your personal property.

LLCs and joint stock companies limit their shareholders’ liability, so personal assets are protected.

Taxes: How you and your business are taxed is dependent on the business structure you choose. You should evaluate the different types of taxes that come with each structure. Polish tax law is complicated and full of exemptions – it is always beneficial to consult a tax lawyer.

If your business is going to trade in more than one country, you need to plan how to fit your business structure into the complex world of international tax.

Funding: typically, lenders are wary of providing funding to sole proprietorships. These types of business structures are sometimes seen as riskier investments. If you are focused on receiving funding from an outside lender, be sure to understand the type of business structure they prefer. LLCs and joint stock companies offer more opportunities.

Read also

January 29, 2026

NDAs: Essential Shields for Trade Secrets in Poland's...

In today's competitive landscape, proactive secret management isn't optional - it's a strategic edge. Non-disclosure agreements (NDAs) have become...

Read moreJanuary 16, 2026

Practical Steps to Transfer Shares in a Polish Sp z...

Are you going to transfer shares in a Polish sp z o.o.? Follow the Commercial Companies Code strictly or risk invalidity. Transferring...

Read moreJanuary 15, 2026

WEBINAR: Practical Steps to Transfer Shares in Polish...

Transferring shares in a Polish sp. z o.o. requires a structured process governed by the Commercial Companies Code to ensure legal validity,...

Read more